Convertible Bond

In financial terms, a convertible bond, also known as convertible note or convertible bond, is an obligator's right to convert his bond, note, or bond into cash or shares of stock of an issuing company. It's a hybrid financial instrument with equity and debt-like characteristics. It's one of the most highly traded financial instruments in the market. A convertible bond normally issues at least one common stock, although some instruments issue two or more stocks.

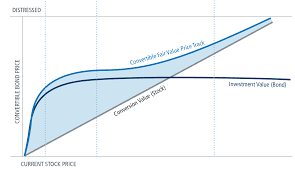

The bond generally pays the holder's a coupon after it's converted into the seller's shares of stock. The coupon rate is determined by a formula applied to the market value of the issuer's stock and the present value of the coupon payment. The price of the bond depends on various factors such as the market price of the underlying stock, if there is any current market interest rate, and the economic condition of the issuing business. Convertible bonds are different from other financial instruments because they have no early redemption value.

There are two types of convertible bond: common and preferred. A common bond is usually issued by companies with more than one common share. The price of such bonds depends on the price of the common stock plus the dividend rate, if any, of the issuer. It may also be convertible into common stock at the option of the issuer.

A preferred bond is different from a common bond because the price it will be converted into is determined according to the discretion of the issuer. It's more complicated than a common bond because the interest rate on a preferred bond is usually fixed. The maturity date and the coupon of a preferred bond can vary, though. If the interest rate is low, the bond may pay lower dividends and higher interest.

Debt conversion is the process of changing one kind of debt to another. There are various reasons why creditors convert debts into other types of debt. One example is when a business accepts a loan from a private investor. The money used for starting the business may already be secured in some form, such as accounts receivable or working capital. This will allow the owner to take out loans in his name, which would otherwise be impossible.

Common stocks are unlisted stocks that are owned by the company. They have not been issued under the company's capital structure. They have a date of issue, usually a date agreed upon by the Board of Directors and the CEO. The price of common stock can change based on many factors, including the performance of the company and general market conditions. When the CEO sells a percentage of his common stock or when a Board of Directors tries to wind down the company, holders will receive a dividend.

Convertible bonds typically come from the merchant bank or credit union that issued the common stock. If the company does not intend to list its stock on the open market, it may choose to convert the bond into a bond instead. This means that the borrower, who is usually a commercial bank or credit union, will receive payment instead of receiving interest on the principal amount. When the company is no longer trading on the open market, the convertible bond will be converted to a debt security.

Since convertible securities cannot be purchased directly by the borrower, they are normally sold by an underwriter to a financial institution or dealer. The dealer may pay a premium to the underwriter for bringing the bond to them. While the borrower receives interest only, the conversion of the bond will usually result in taxable income to the investor. There are special rules regarding convertible bond conversions.

thank you for the advice

ReplyDeletehttp://tech.harbourfronts.com/derivative-valuation-how-to-price-a-convertible-bond/