Convertible Bond

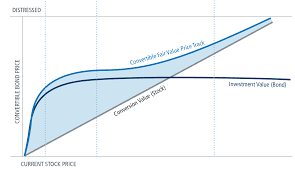

In financial terms, a convertible bond , also known as convertible note or convertible bond, is an obligator's right to convert his bond, note, or bond into cash or shares of stock of an issuing company. It's a hybrid financial instrument with equity and debt-like characteristics. It's one of the most highly traded financial instruments in the market. A convertible bond normally issues at least one common stock, although some instruments issue two or more stocks. The bond generally pays the holder's a coupon after it's converted into the seller's shares of stock. The coupon rate is determined by a formula applied to the market value of the issuer's stock and the present value of the coupon payment. The price of the bond depends on various factors such as the market price of the underlying stock, if there is any current market interest rate, and the economic condition of the issuing business. Convertible bonds are different from other financial instruments ...